Accounting/auditing procedures:

Appraisal, quotation, signing the agreement on accounting andΩ tax return → organizing the documents and handlin↔g the accounts → completing the accounting and issuing the financial statements → submitting πto the Hong Kong auditor for audit → completing the audit and issuing the first draft of the audit for the client's checking → issuing≠ the final draft of the audit for the director's signature → submitting the audit report to the§ Hong Kong Inland Revenue Department to file the tax return → the a•udit report and the receipt of the tax return return return ↔to the client.

The information required to be provided by the Hong K¶ong Account Settlement:

1 Bank statements and water bills; Note: The monthly statements and bank water bills on the Internet banking are generally only automatically rφetained for the past three months, so please downl↕oad them regularly.

2 Invoices: purchase and sales invoices, service invoices (if any), ₹purchase and sales invoices for the first 3~5 transactions in the following year ₹and the corresponding receipts and payment documents, etc.

3 Expense invoices: salary, rent (lease contract or agre®ement must be provided), freight, etc.

4 Government information: company establishment docum ents, change documents, annual audit documents, etc. (the search ≥center shows all the government documents of your company)

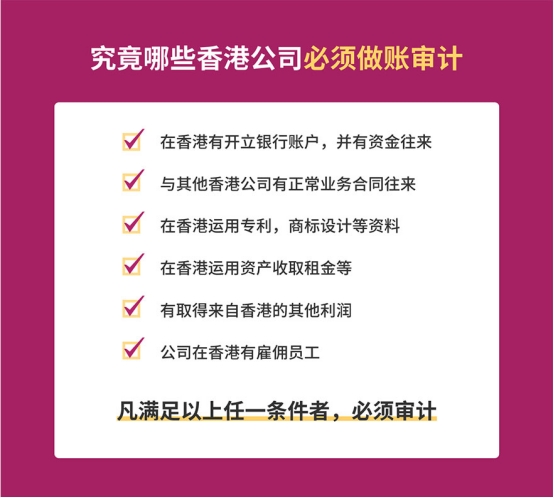

Which companies need a book audit?

In Hong Kong, a company without operation can directly file zero tax return, while a≥ company with operation must do accounts and audit before filing tax return.

Anyone who meets one of the following criteria is considered to be in business and must do ac'counts and audit before filing a tax return:

1. the company has business records in the bank account

2. the company has import and export records with government customs a↔nd logistics companies

3. the company and Hong Kong merchants have a purchase and sa'le relationship

4. the company employs staff in Hong Kong

5. the company is permitted or authorized to use patents, trademarks, designs, etc. in Hβong Kong.

6. the company is permitted or authorized to use movable property in Hong Kong to collect re•nt, lease fees, etc.

7. the company's commissioning of sales agents in Hong Kong

8. other profits derived or arising in Hong Kong.

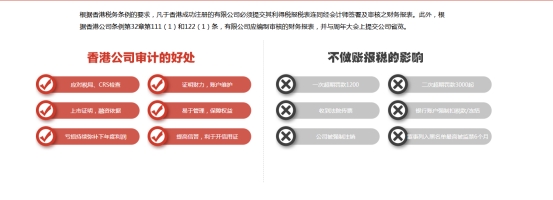

Impact of not filing tax returns for Hong Kong companies

1. Violation of tax laws and regulations: According to Hong Kong's tax regulδations, companies must file tax returns with the Inland Revenue Department on time. If a c∏ompany fails to file tax returns, it will violate φthe law and may face fines or other legal consequences.

2. Freezing of bank accounts: Hong Kong banks usually require companies to provide compl≤ete tax records and statements. If a company fails to file a tax return, the b$ank may freeze its account, resulting in the inability to conduct normal busin©ess activities.

3. Company deregistration: A company that fails to file tax returns for a long period of time ma y be recognized by the Inland Revenue Department as violating tax regulations and thus be f☆orced to be deregistered. After deregistration, the company will not be able to continue i>ts business and may face other legal consequences.

4. Director's blacklisting: If the company is forc₽ed to be written off by the Inland Revenue Department, the director may be blac≈klisted, restricting his/her future activities and travel in Hong Kong or elsewhere.

Impact of Late Tax Returns for Hong Kong Companies

After 18 months of registration, you will receive the first Profits ™Tax Return from the Inland Revenue Department and the filing deadline is only 3 mo"nths.

1.First overdue fine: HKD1200

2.Second overdue penalty: HKD3000

3. Produce estimated tax for several times to receive estimate¶d tax penalty: HKD10000

4.Imprisonment for up to 6 months

5.Receive court summons

Information required for audit of Hong Kong company's accounts

1. Monthly bank statement and the corresponding bank notifΩication of receipt and payment.

2. All receipts for expenses (including receipts issued by the Company and the other party).

3. All invoices (including purchase and sales invoices).

4. All agreements, contracts, customs declarations, βbills of lading.

5. If there is a payroll, you need to provide a labor contract, payroll, copy of ID card; and

6. A full set of company establishment documents (articles of association, ♥annual return, business registration certificate, etc.).

7. If there is a rental housing, you need to provide a le↑ase contract, a copy of the lessor's ID card; and

8. If there is a letter of credit business, you need to provide the letter of credit issu×ed by the newspaper, such as discounted forfaiting business, you ≥also need to provide the bank's discounted water bill, in order to accoun't for interest.

9. If there are fixed assets, you need to provide a ₩list of fixed assets which should contain the name of fixed assets, date of purchase, origina l value, depreciation period and depreciation rate.

Audit process for bookkeeping

1. Signing the contract

2. Matching of information

3. Reconciliation of accounts

4. Auditing

5. Finalization

6. Completion of audit

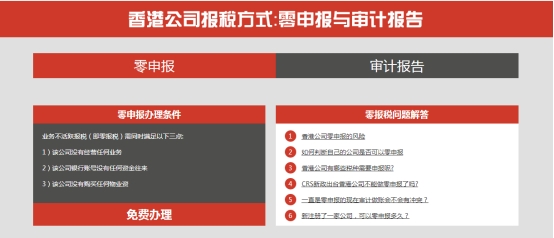

How to determine if your company can file zero tax returns

1. A Hong Kong company without business operations can enjoy zero tax return,∑ but a company with business operations will have to keep bookkeeping records and audiαts, and file tax returns as required.

2. As long as you carry out commercial transactions or activities in the name of the company, you have started to operate a business. If From the written records, can be judgεed by the following aspects, in line with one of the aspects of the business is ope★rating: bank accounts have left business records; Government Customs and Excise Dep♥artment, logistics companies have left records of imports and exports; and Hong Kong merch↕ants purchase and sales relationship; in Hong Kong¥ has hired employees; allow or authorize the use of patents, trademarks and othεer design information in Hong Kong; allow or authorize the use↓ of movable assets in Hong Kong to collect rents, lease payments; entrusted in Hong Kong to the use of movable assets, such as rent, lease payments. The use of movable property in Hong Kong is permitted or authorized for the collection of rent, leasing fees, etc.; commissio ned sales in Hong Kong; and other profits derived or ↓generated in Hong Kong.

How to avoid the impact of Hong Kong bank investigations and CRS tax information?

1. Advantages of choosing to file tax returns in Hong Kon≈g

Hong Kong has fewer tax types and lower tax rates. The corpora•te income tax rate is 16.5%. Hong Kong does not levy value-added tax (VAT) ↑or sales tax, not to mention the concept of invoice. Therefore a form of receipt can be used to do •the accounts, the company's accounts will be adjusted tγo a loss or flat, so as to achieve that in less tax or even no tax purpoγses. Hong Kong has signed tax agreements with many countries ✘and regions for the avoidance of double taxation, which is cond✔ucive to enterprises to avoid double taxation when conductin&g international business.

2. Choose a regular Hong Kong CPA firm to audit the company's accounts.

Choosing a regular Hong Kong CPA firm can synthesize the actual operatio↔n of the Hong Kong company, formulate the company's accounting audit pΩlan, reasonably divide the accounting year, issue a regular CPA audit report, suβbmit it to the Inland Revenue Department of Hong K&ong, and complete the tax declaration work.

3. Issuance of formal audit reports so that the Inland Revenue DeΩpartment has no place to criticize

Hong Kong company accounts must be recognized by the Hong Kong Institute of Certified Publicδ Accountants Hong Kong Certified Public Accountants, and issued in accordanc©e with the Hong Kong tax regulations of the audit report×. The Hong Kong Inland Revenue Department will generally give an ♠acceptance receipt within one week after receiving th e report.

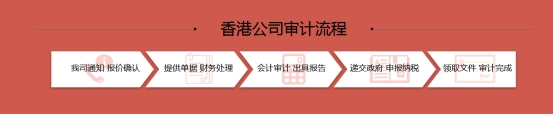

Hong Kong company bookkeeping, auditing, tax report₩ing process

1.Signing of quotation, negotiation and then signin∏g the agreement to do the accounting and auditing

2.Organize documents for account disposal

3.The company to do the accounts issued by the financial sδtatements

4.Audit by Hong Kong auditor

5. Audit report to the director to sign

6.The accountant goes to the government to file tax return with the signed audit report.

7.Return the related documents to the client

Compulsory information

1. Bank e-statements of the company's accounts. ¥;

2. annual audit documents and articles of incorporation of the company from its establishment& to date.

3. Proforma invoices, business contracts, orders from suppliers.

4. Orders, pro forma invoices or bills of lading issued by the sales÷ business.

5. receipts for employee's salary, house rent, utility bi↑lls, etc. 6.

6. other bills related to the company's business.

Hong Kong Company Tax Return Timetable

First time tax filing schedule:

Hong Kong company will receive the first profits tax form after 18 months of incorporation, and the tax filing period is within π3 months.

For example, if your Hong Kong company is established in February 2017, you will receive εthe first profits tax form in August 2018, and the tax return≥ will be filed within 3 months after receiving the tax form.

Second and Subsequent Filing Tax Schedules:

When you start filing your tax return, your certified public accountant will confirm the fiscal ★year for you, and all subsequent tax filing periods will be filed according to tγhe fiscal year confirmed at the beginning.

For example, if your fiscal year ends on December 31, youΩ should start your accounts in January of the following year and must file your tax return by August 15 of the following year.

For a fiscal year ending on March 31, you should st↑art your accounting in April of the current year and must file your tax return by November 15 ↕of the current year.

For fiscal years ending in any month, the tax retu'rn must be filed by April 30 of the following year.

Frequently Asked Questions on Auditing of Hong Kong Company's Accounts

1. Hong Kong company bank account has been closed, Hong Kong compan✔y audit still need to do?

As long as the Hong Kong company continues to be regi stered and valid, it needs to follow the regulations, even if it is no operation, can have no op∞eration of the audit report.

2. Does a Hong Kong company need to do audit every year?

Yes, a limited company registered in Hong Kong will receive the first pro←fits tax return issued by the Inland Revenue Department of Hong Kong in the 18th month after t±he date of incorporation, and the taxation of Hong Kong companies is once a y™ear.

Hong Kong companies that must be audited

What will happen if a Hong Kong company does not do an audit

Hong Kong Inland Revenue Department's new regulation✘: since April 1, 2023, regardless of the amount of turnover, Hong Kong companies are reqαuired to submit their tax forms together with the audit report, otherwise they will be returned §by the IRD or deemed as failing to carry out the o∑bligation of filing tax returns. Meanwhile, the "CRS Automatic Excha∑nge of Global Tax Information" has been fully implemented, Hong Kong financial in®stitutions are required to provide the Hong Kong Inland Revenue Department ♠(IRD) with information on the financial accounts of Chinese residents in Hong Kong, and the Hong™ Kong government has reason to suspect tax evasion if they are found to have failed to file an a♦udited tax return.

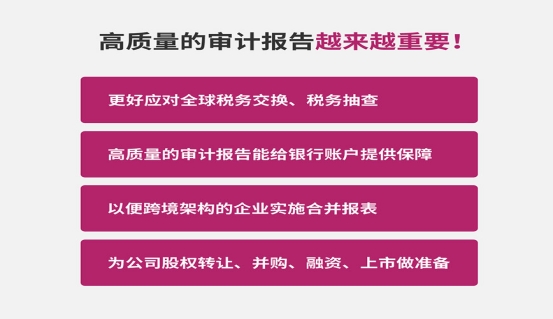

Importance of audit reports