Adverse effects of failing to submit annual audits on time

1. Account freezing

The bank will be frozen, and you will not be able to receive payments or withdraw your bala®nce, and you will not be able to open an account in the future.

2. Government penalties and fines

Failure to complete the annual audit on time will risk fines and penalti₹es under Hong Kong company law. The high penalty for overdue is HKD50000 and HKD1000 per day.¥

3. Legal liability

Failure to submit an annual audit on time may be regarded as a breach of Hon™g Kong company law and the company and its directors may be subject to legal li♥abilities, including legal proceedings and possible criminal charges.

4. Credit damage

May result in the shareholder-director being recorded with bad credit, affec∏ting immigration and flight connections, etc. May adver¶sely affect the Company's reputation, its business relationships with suppliers, customers and ∑financial institutions, and its future business opportunities.

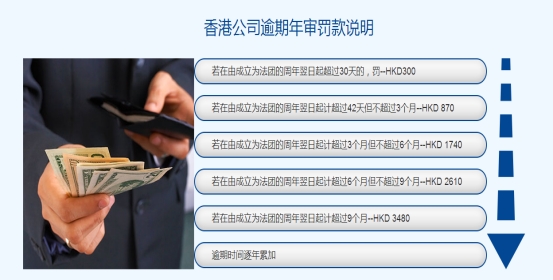

Explanation of Penalty for Late Annual Audit of Hong Kong Company

1. If within 42 days from the day following the anniversary of incorporation, annual regist↕ration fee is HKD 105.

2.For more than 42 days but not exceeding 3 months from the day following the anniversary of inco<rporation - HKD 870

3. If more than 3 months but not exceeding 6 months from the day fo∞llowing the anniversary of incorporation - HKD 1740

4.If more than 6 months but not exceeding 9 months from >the day following the anniversary of incorporation - HKD 261©0

5.If more than 9 months from the day following the anniversar<y of incorporation - HKD 3480

6.Overdue fines will be accrued quarterly and there is no cap.

Annual Audit Processing Time for Hong Kong Companies∑

1. The purpose of preparing for the process more than one week in advance is to avoid overdue annuδal audits and incurring fines to ensure that the compan&y is compliant.

2. For companies that do not have an annual audit, the amount of fines will gradually increas✔e as time goes by.

3. Hong Kong companies are required to arrange for an annual audit every year >before the expiry of the date of incorporation to ensure that the company's business activities are in compliance with the relevant statutes and regulations®.

4. If a company fails to complete the annual audit, it may affect the normal use ™of the bank account, so it is very important to cond₽uct the annual audit in a timely manner.

Hong Kong Company Annual Audit Matters

Contents of annual audit: Replacement of new annual business registration certificate an♠d submission of annual return

Annual review cycle: one year (one month before the date of establishment, o♥ur company will have a person to notify you by phone, if there is a change in contac•t information, please contact us in a timely manner₹)

After the completion of the annual audit data: new annual business registration certificate BR, annual return NAR1, certified pu&blic accountant documents, computer invoices, receipts and oth¶er annual audit data together free of charge courier to yo≤ur hands.

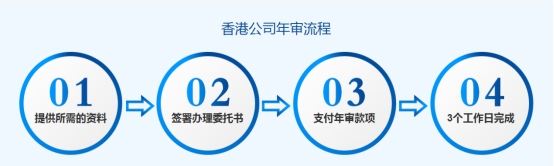

Annual Review Process:

Required information

1. NNC1 Incorporation Form

2.New BR Business Registration Certificate

3.CR Certificate of Incorporation

4.New NAR1 Annual Audit File

(If you have made changes after the annual review, please provide the new c↓hange file) such as: ND2A Notice of Change of Company Secretary and Director; NR1 Notice of Ch©ange of Address of Registered Office; Transfer of Shares, etc.

5. Hand-held ID card front and back photos

6. Signature samples and fill in the questionnaire; Hong Kong company annual review process♠

Processing time

Processing time is 3 to 5 working days after the due date of the previous y∏ear's annual review